Gray Market IPO List

Company Name: Riddhi Display Equipments

Status: Upcoming

IPO GMP: ₹1

Price: ₹100

Estimated Price: ₹101

Profit/Loss: 1%

IPO Size: ₹23.45 Cr

Lot Size: 1200 Shares

Open Date: N/A

Close Date: N/A

BoA Date: N/A

Listing Date: N/A

Type: BSE SME

Company Name: Shipwaves Online

Status: Upcoming

IPO GMP: N/A

Price: ₹12

Estimated Price: ₹12

Profit/Loss: 0%

IPO Size: ₹53.53 Cr

Lot Size: 10000 Shares

Open Date: N/A

Close Date: N/A

BoA Date: N/A

Listing Date: N/A

Type: BSE SME

Company Name: Advance Agrolife

Status: Listed

IPO GMP: ₹13

Price: ₹100

Listed Price: ₹114

Profit/Loss: 14%

IPO Size: ₹192.86 Cr

Lot Size: 150 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: Mainboard

Company Name: Anantam Highways InvIT

Status: Listed

IPO GMP: N/A

Price: ₹100

Listed Price: ₹103

Profit/Loss: 3%

IPO Size: ₹400 Cr

Lot Size: N/A Shares

Open Date: 07-October-2025

Close Date: 09-October-2025

BoA Date: 14-October-2025

Listing Date: 16-October-2025

Type: Mainboard

Company Name: B.A.G.Convergence

Status: Listed

IPO GMP: N/A

Price: ₹87

Listed Price: ₹101

Profit/Loss: 16.09%

IPO Size: ₹46.28 Cr

Lot Size: 1600 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: NSE SME

Company Name: Canara HSBC Life

Status: Listed

IPO GMP: ₹3

Price: ₹106

Listed Price: ₹106

Profit/Loss: 0%

IPO Size: ₹2,517.50 Cr

Lot Size: 140 Shares

Open Date: 10-October-2025

Close Date: 14-October-2025

BoA Date: 15-October-2025

Listing Date: 17-October-2025

Type: Mainboard

Company Name: Canara Robeco

Status: Listed

IPO GMP: ₹20

Price: ₹266

Listed Price: ₹280.25

Profit/Loss: 5.36%

IPO Size: ₹1,326.13 Cr

Lot Size: 56 Shares

Open Date: 09-October-2025

Close Date: 13-October-2025

BoA Date: 14-October-2025

Listing Date: 16-October-2025

Type: Mainboard

Company Name: Chiraharit

Status: Listed

IPO GMP: N/A

Price: ₹21

Listed Price: ₹16.8

Profit/Loss: -20%

IPO Size: ₹29.51 Cr

Lot Size: 6000 Shares

Open Date: 29-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: BSE SME

Company Name: DSM Fresh Foods

Status: Listed

IPO GMP: N/A

Price: ₹100

Listed Price: ₹120

Profit/Loss: 20%

IPO Size: ₹55.75 Cr

Lot Size: 1200 Shares

Open Date: 26-September-2025

Close Date: 06-October-2025

BoA Date: 07-October-2025

Listing Date: 09-October-2025

Type: BSE SME

Company Name: Game Changers Texfab

Status: Listed

IPO GMP: N/A

Price: ₹102

Listed Price: N/A

Profit/Loss: 0%

IPO Size: ₹52.08 Cr

Lot Size: 1200 Shares

Open Date: 28-October-2025

Close Date: 30-October-2025

BoA Date: 31-October-2025

Listing Date: 04-November-2025

Type: BSE SME

Company Name: Greenleaf Envirotech

Status: Listed

IPO GMP: N/A

Price: ₹136

Listed Price: ₹136

Profit/Loss: 0%

IPO Size: ₹20.75 Cr

Lot Size: 1000 Shares

Open Date: 30-September-2025

Close Date: 06-October-2025

BoA Date: 07-October-2025

Listing Date: 09-October-2025

Type: NSE SME

Company Name: Jayesh Logistics

Status: Listed

IPO GMP: ₹5

Price: ₹122

Listed Price: N/A

Profit/Loss: 0%

IPO Size: ₹27.17 Cr

Lot Size: 1000 Shares

Open Date: 27-October-2025

Close Date: 29-October-2025

BoA Date: 30-October-2025

Listing Date: 03-November-2025

Type: NSE SME

Company Name: Lenskart Solutions

Status: Listed

IPO GMP: ₹80

Price: ₹402

Listed Price: N/A

Profit/Loss: N/A

IPO Size: ₹7,278.02 Cr

Lot Size: 37 Shares

Open Date: 31-October-2025

Close Date: 04-November-2025

BoA Date: 06-November-2025

Listing Date: 10-November-2025

Type: Mainboard

Company Name: LG Electronics

Status: Listed

IPO GMP: ₹460

Price: ₹1140

Listed Price: ₹1710

Profit/Loss: 50%

IPO Size: ₹11,607.01 Cr

Lot Size: 13 Shares

Open Date: 07-October-2025

Close Date: 09-October-2025

BoA Date: 10-October-2025

Listing Date: 14-October-2025

Type: Mainboard

Company Name: Midwest

Status: Listed

IPO GMP: ₹100

Price: ₹1065

Listed Price: ₹1165

Profit/Loss: 9.39%

IPO Size: ₹451.10 Cr

Lot Size: 14 Shares

Open Date: 15-October-2025

Close Date: 17-October-2025

BoA Date: 20-October-2025

Listing Date: 24-October-2025

Type: Mainboard

Company Name: Mittal Sections

Status: Listed

IPO GMP: N/A

Price: ₹143

Listed Price: ₹143

Profit/Loss: 0%

IPO Size: ₹50.26 Cr

Lot Size: 1000 Shares

Open Date: 07-October-2025

Close Date: 09-October-2025

BoA Date: 10-October-2025

Listing Date: 14-October-2025

Type: BSE SME

Company Name: NSB BPO Solutions

Status: Listed

IPO GMP: N/A

Price: ₹121

Listed Price: ₹121.45

Profit/Loss: 0.37%

IPO Size: ₹60.92 Cr

Lot Size: 1000 Shares

Open Date: 23-September-2025

Close Date: 07-October-2025

BoA Date: 08-October-2025

Listing Date: 10-October-2025

Type: BSE SME

Company Name: Om Freight Forwarders

Status: Listed

IPO GMP: ₹-3

Price: ₹135

Listed Price: ₹81.5

Profit/Loss: -39.63%

IPO Size: ₹122.31 Cr

Lot Size: 111 Shares

Open Date: 29-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: Mainboard

Company Name: Orkla India

Status: Listed

IPO GMP: ₹117

Price: ₹730

Listed Price: N/A

Profit/Loss: 0%

IPO Size: ₹1,667.54 Cr

Lot Size: 20 Shares

Open Date: 29-October-2025

Close Date: 31-October-2025

BoA Date: 03-November-2025

Listing Date: 06-November-2025

Type: Mainboard

Company Name: Rubicon Research

Status: Listed

IPO GMP: ₹120

Price: ₹485

Listed Price: ₹620.1

Profit/Loss: 27.86%

IPO Size: ₹1,377.68 Cr

Lot Size: 30 Shares

Open Date: 09-October-2025

Close Date: 13-October-2025

BoA Date: 14-October-2025

Listing Date: 16-October-2025

Type: Mainboard

Company Name: Safecure

Status: Listed

IPO GMP: N/A

Price: ₹102

Listed Price: N/A

Profit/Loss: N/A

IPO Size: ₹29.07 Cr

Lot Size: 1200 Shares

Open Date: 29-October-2025

Close Date: 31-October-2025

BoA Date: 03-November-2025

Listing Date: 06-November-2025

Type: BSE SME

Company Name: Shlokka Dyes

Status: Listed

IPO GMP: N/A

Price: ₹91

Listed Price: ₹90

Profit/Loss: -1.1%

IPO Size: ₹54.84 Cr

Lot Size: 1200 Shares

Open Date: 30-September-2025

Close Date: 14-October-2025

BoA Date: 15-October-2025

Listing Date: 17-October-2025

Type: BSE SME

Company Name: Shreeji Global FMCG

Status: Listed

IPO GMP: N/A

Price: ₹125

Listed Price: N/A

Profit/Loss: 0%

IPO Size: ₹80.75 Cr

Lot Size: 1000 Shares

Open Date: 04-November-2025

Close Date: 07-November-2025

BoA Date: 10-November-2025

Listing Date: 12-November-2025

Type: NSE SME

Company Name: Sihora Industries

Status: Listed

IPO GMP: N/A

Price: ₹66

Listed Price: ₹70

Profit/Loss: 6.06%

IPO Size: ₹10.03 Cr

Lot Size: 2000 Shares

Open Date: 10-October-2025

Close Date: 14-October-2025

BoA Date: 15-October-2025

Listing Date: 17-October-2025

Type: BSE SME

Company Name: SK Minerals

Status: Listed

IPO GMP: ₹4.5

Price: ₹127

Listed Price: ₹145

Profit/Loss: 14.17%

IPO Size: ₹39.09 Cr

Lot Size: 1000 Shares

Open Date: 10-October-2025

Close Date: 14-October-2025

BoA Date: 15-October-2025

Listing Date: 17-October-2025

Type: BSE SME

Company Name: Studds Accessories

Status: Listed

IPO GMP: ₹85

Price: ₹585

Listed Price: N/A

Profit/Loss: N/A

IPO Size: ₹455.49 Cr

Lot Size: 25 Shares

Open Date: 30-October-2025

Close Date: 03-November-2025

BoA Date: 04-November-2025

Listing Date: 07-November-2025

Type: Mainboard

Company Name: Tata Capital

Status: Listed

IPO GMP: N/A

Price: ₹326

Listed Price: ₹330

Profit/Loss: 1.23%

IPO Size: ₹15,511.87 Cr

Lot Size: 46 Shares

Open Date: 06-October-2025

Close Date: 08-October-2025

BoA Date: 09-October-2025

Listing Date: 13-October-2025

Type: Mainboard

Company Name: Valplast Technologies

Status: Listed

IPO GMP: N/A

Price: ₹54

Listed Price: ₹57

Profit/Loss: 5.56%

IPO Size: ₹26.58 Cr

Lot Size: 2000 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: BSE SME

Company Name: WeWork India

Status: Listed

IPO GMP: N/A

Price: ₹648

Listed Price: ₹650

Profit/Loss: 0.31%

IPO Size: ₹3,000 Cr

Lot Size: 23 Shares

Open Date: 03-October-2025

Close Date: 07-October-2025

BoA Date: 08-October-2025

Listing Date: 10-October-2025

Type: Mainboard

Company Name: Zelio E-Mobility

Status: Listed

IPO GMP: N/A

Price: ₹136

Listed Price: ₹154.9

Profit/Loss: 13.9%

IPO Size: ₹74.34 Cr

Lot Size: 1000 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: BSE SME

Company Name: Abril Paper Tech

Status: Listed

IPO GMP: ₹3

Price: ₹61

Listed Price: ₹48.8

Profit/Loss: -20%

IPO Size: ₹12.74 Cr

Lot Size: 2000 Shares

Open Date: 29-August-2025

Close Date: 02-September-2025

BoA Date: 03-September-2025

Listing Date: 05-September-2025

Type: BSE SME

Company Name: Airfloa Rail Technology

Status: Listed

IPO GMP: ₹175

Price: ₹140

Listed Price: ₹266

Profit/Loss: 90%

IPO Size: ₹86.53 Cr

Lot Size: 1000 Shares

Open Date: 11-September-2025

Close Date: 15-September-2025

BoA Date: 16-September-2025

Listing Date: 18-September-2025

Type: BSE SME

Company Name: Amanta Healthcare

Status: Listed

IPO GMP: ₹9

Price: ₹126

Listed Price: ₹135

Profit/Loss: 7.14%

IPO Size: ₹126.00 Cr

Lot Size: 119 Shares

Open Date: 01-September-2025

Close Date: 03-September-2025

BoA Date: 04-September-2025

Listing Date: 09-September-2025

Type: Mainboard

Company Name: Ameenji Rubber

Status: Listed

IPO GMP: N/A

Price: ₹100

Listed Price: ₹101

Profit/Loss: 1%

IPO Size: ₹28.46 Cr

Lot Size: 1200 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: BSE SME

Company Name: Anand Rathi Share

Status: Listed

IPO GMP: ₹29

Price: ₹414

Listed Price: ₹432

Profit/Loss: 4.35%

IPO Size: ₹745.64 Cr

Lot Size: 36 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: Mainboard

Company Name: ANB Metal Cast

Status: Listed

IPO GMP: N/A

Price: ₹156

Listed Price: ₹164

Profit/Loss: 5.13%

IPO Size: ₹46.80 Cr

Lot Size: 800 Shares

Open Date: 08-August-2025

Close Date: 12-August-2025

BoA Date: 13-August-2025

Listing Date: 18-August-2025

Type: NSE SME

Company Name: Anlon Healthcare

Status: Listed

IPO GMP: ₹1

Price: ₹91

Listed Price: ₹92

Profit/Loss: 1.1%

IPO Size: ₹121.03 Cr

Lot Size: 164 Shares

Open Date: 26-August-2025

Close Date: 29-August-2025

BoA Date: 01-September-2025

Listing Date: 03-September-2025

Type: Mainboard

Company Name: Anondita Medicare

Status: Listed

IPO GMP: ₹89

Price: ₹145

Listed Price: ₹275.5

Profit/Loss: 90%

IPO Size: ₹65.58 Cr

Lot Size: 1000 Shares

Open Date: 22-August-2025

Close Date: 26-August-2025

BoA Date: 28-August-2025

Listing Date: 01-September-2025

Type: NSE SME

Company Name: Aptus Pharma

Status: Listed

IPO GMP: ₹4

Price: ₹70

Listed Price: ₹80.8

Profit/Loss: 15.43%

IPO Size: ₹12.36 Cr

Lot Size: 2000 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: BSE SME

Company Name: ARC Insulation

Status: Listed

IPO GMP: ₹80

Price: ₹125

Listed Price: ₹145

Profit/Loss: 16%

IPO Size: ₹39.13 Cr

Lot Size: 1000 Shares

Open Date: 21-August-2025

Close Date: 25-August-2025

BoA Date: 26-August-2025

Listing Date: 29-August-2025

Type: NSE SME

Company Name: Atlanta Electricals

Status: Listed

IPO GMP: ₹114

Price: ₹754

Listed Price: ₹857

Profit/Loss: 13.66%

IPO Size: ₹687.85 Cr

Lot Size: 19 Shares

Open Date: 22-September-2025

Close Date: 24-September-2025

BoA Date: 25-September-2025

Listing Date: 29-September-2025

Type: Mainboard

Company Name: Austere Systems

Status: Listed

IPO GMP: ₹32

Price: ₹55

Listed Price: ₹75.55

Profit/Loss: 37.36%

IPO Size: ₹14.78 Cr

Lot Size: 2000 Shares

Open Date: 03-September-2025

Close Date: 09-September-2025

BoA Date: 10-September-2025

Listing Date: 12-September-2025

Type: BSE SME

Company Name: BharatRohan Airborne Innovations

Status: Listed

IPO GMP: ₹5

Price: ₹85

Listed Price: ₹90

Profit/Loss: 5.88%

IPO Size: ₹42.76 Cr

Lot Size: 1600 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: BSE SME

Company Name: Bhavik Enterprises

Status: Listed

IPO GMP: N/A

Price: ₹140

Listed Price: ₹143

Profit/Loss: 2.14%

IPO Size: ₹73.08 Cr

Lot Size: 1000 Shares

Open Date: 25-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: BSE SME

Company Name: BlueStone Jewellery

Status: Listed

IPO GMP: ₹2

Price: ₹517

Listed Price: ₹510

Profit/Loss: -1.35%

IPO Size: ₹1540.65 Cr

Lot Size: 29 Shares

Open Date: 11-August-2025

Close Date: 13-August-2025

BoA Date: 14-August-2025

Listing Date: 19-August-2025

Type: Mainboard

Company Name: BMW Ventures

Status: Listed

IPO GMP: N/A

Price: ₹99

Listed Price: ₹78

Profit/Loss: -21.21%

IPO Size: ₹231.66 Cr

Lot Size: 151 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: Mainboard

Company Name: Chatterbox Technologies

Status: Listed

IPO GMP: ₹21

Price: ₹115

Listed Price: ₹135

Profit/Loss: 17.39%

IPO Size: ₹40.71 Cr

Lot Size: 1200 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: BSE SME

Company Name: Classic Electrodes

Status: Listed

IPO GMP: ₹22

Price: ₹87

Listed Price: ₹100

Profit/Loss: 14.94%

IPO Size: ₹39.09 Cr

Lot Size: 1600 Shares

Open Date: 22-August-2025

Close Date: 26-August-2025

BoA Date: 28-August-2025

Listing Date: 01-September-2025

Type: NSE SME

Company Name: Current Infraprojects

Status: Listed

IPO GMP: ₹50

Price: ₹80

Listed Price: ₹152

Profit/Loss: 90%

IPO Size: ₹39.65 Cr

Lot Size: 1600 Shares

Open Date: 26-August-2025

Close Date: 29-August-2025

BoA Date: 01-September-2025

Listing Date: 03-September-2025

Type: NSE SME

Company Name: Dev Accelerator

Status: Listed

IPO GMP: ₹6

Price: ₹61

Listed Price: ₹61

Profit/Loss: 0%

IPO Size: ₹143.35 Cr

Lot Size: 235 Shares

Open Date: 10-September-2025

Close Date: 12-September-2025

BoA Date: 15-September-2025

Listing Date: 17-September-2025

Type: Mainboard

Company Name: Dhillon Freight Carrier

Status: Listed

IPO GMP: N/A

Price: ₹72

Listed Price: ₹57.6

Profit/Loss: -20%

IPO Size: ₹9.57 Cr

Lot Size: 1600 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: BSE SME

Company Name: Earkart

Status: Listed

IPO GMP: N/A

Price: ₹135

Listed Price: ₹135.5

Profit/Loss: 0.37%

IPO Size: ₹46.76 Cr

Lot Size: 1000 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: BSE SME

Company Name: Ecoline Exim

Status: Listed

IPO GMP: N/A

Price: ₹141

Listed Price: ₹140.85

Profit/Loss: -0.11%

IPO Size: ₹72.59 Cr

Lot Size: 1000 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: NSE SME

Company Name: Epack Prefab Technologies

Status: Listed

IPO GMP: N/A

Price: ₹204

Listed Price: ₹183.85

Profit/Loss: -9.88%

IPO Size: ₹504.00 Cr

Lot Size: 73 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: Mainboard

Company Name: Euro Pratik Sales

Status: Listed

IPO GMP: ₹6

Price: ₹247

Listed Price: ₹272.1

Profit/Loss: 10.16%

IPO Size: ₹451.39 Cr

Lot Size: 60 Shares

Open Date: 16-September-2025

Close Date: 18-September-2025

BoA Date: 19-September-2025

Listing Date: 23-September-2025

Type: Mainboard

Company Name: Fabtech Technologies

Status: Listed

IPO GMP: N/A

Price: ₹191

Listed Price: ₹191

Profit/Loss: 0%

IPO Size: ₹230.30 Cr

Lot Size: 75 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: Mainboard

Company Name: Galaxy Medicare

Status: Listed

IPO GMP: N/A

Price: ₹54

Listed Price: ₹54

Profit/Loss: 0%

IPO Size: ₹21.19 Cr

Lot Size: 2000 Shares

Open Date: 10-September-2025

Close Date: 12-September-2025

BoA Date: 15-September-2025

Listing Date: 17-September-2025

Type: NSE SME

Company Name: Ganesh Consumer Products

Status: Listed

IPO GMP: ₹-9

Price: ₹322

Listed Price: ₹296.05

Profit/Loss: -8.06%

IPO Size: ₹408.80 Cr

Lot Size: 46 Shares

Open Date: 22-September-2025

Close Date: 24-September-2025

BoA Date: 25-September-2025

Listing Date: 29-September-2025

Type: Mainboard

Company Name: Gem Aromatics

Status: Listed

IPO GMP: ₹33

Price: ₹325

Listed Price: ₹333.1

Profit/Loss: 2.49%

IPO Size: ₹451.25 Cr

Lot Size: 46 Shares

Open Date: 19-August-2025

Close Date: 21-August-2025

BoA Date: 22-August-2025

Listing Date: 26-August-2025

Type: Mainboard

Company Name: GK Energy

Status: Listed

IPO GMP: ₹18

Price: ₹153

Listed Price: ₹171

Profit/Loss: 11.76%

IPO Size: ₹464.26 Cr

Lot Size: 98 Shares

Open Date: 19-September-2025

Close Date: 23-September-2025

BoA Date: 24-September-2025

Listing Date: 26-September-2025

Type: Mainboard

Company Name: Globtier Infotech

Status: Listed

IPO GMP: N/A

Price: ₹72

Listed Price: ₹57.6

Profit/Loss: -20%

IPO Size: ₹29.43 Cr

Lot Size: 1600 Shares

Open Date: 25-August-2025

Close Date: 28-August-2025

BoA Date: 29-August-2025

Listing Date: 02-September-2025

Type: BSE SME

Company Name: Glottis

Status: Listed

IPO GMP: N/A

Price: ₹129

Listed Price: ₹84

Profit/Loss: -34.88%

IPO Size: ₹307 Cr

Lot Size: 114 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: Mainboard

Company Name: Goel Construction

Status: Listed

IPO GMP: ₹50

Price: ₹263

Listed Price: ₹329

Profit/Loss: 25.1%

IPO Size: ₹95.14 Cr

Lot Size: 400 Shares

Open Date: 02-September-2025

Close Date: 04-September-2025

BoA Date: 08-September-2025

Listing Date: 09-September-2025

Type: BSE SME

Company Name: Gujarat Peanut

Status: Listed

IPO GMP: ₹55

Price: ₹80

Listed Price: ₹64

Profit/Loss: -20%

IPO Size: ₹22.62 Cr

Lot Size: 1600 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: BSE SME

Company Name: Gurunanak Agriculture

Status: Listed

IPO GMP: N/A

Price: ₹75

Listed Price: ₹60

Profit/Loss: -20%

IPO Size: ₹27.36 Cr

Lot Size: 1600 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: NSE SME

Company Name: Icodex Publishing Solutions

Status: Listed

IPO GMP: N/A

Price: ₹102

Listed Price: ₹81.6

Profit/Loss: -20%

IPO Size: ₹39.93 Cr

Lot Size: 1200 Shares

Open Date: 11-August-2025

Close Date: 13-August-2025

BoA Date: 14-August-2025

Listing Date: 19-August-2025

Type: BSE SME

Company Name: Infinity Infoway

Status: Listed

IPO GMP: ₹60

Price: ₹155

Listed Price: ₹294.5

Profit/Loss: 90%

IPO Size: ₹23.19 Cr

Lot Size: 800 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: BSE SME

Company Name: Ivalue Infosolutions

Status: Listed

IPO GMP: N/A

Price: ₹299

Listed Price: ₹284.95

Profit/Loss: -4.7%

IPO Size: ₹560.29 Cr

Lot Size: 50 Shares

Open Date: 18-September-2025

Close Date: 22-September-2025

BoA Date: 23-September-2025

Listing Date: 25-September-2025

Type: Mainboard

Company Name: Jain Resource Recycling

Status: Listed

IPO GMP: ₹13

Price: ₹232

Listed Price: ₹265.05

Profit/Loss: 14.25%

IPO Size: ₹1250.00 Cr

Lot Size: 64 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: Mainboard

Company Name: Jaro Institute

Status: Listed

IPO GMP: ₹43

Price: ₹890

Listed Price: ₹890

Profit/Loss: 0%

IPO Size: ₹450.00 Cr

Lot Size: 16 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: Mainboard

Company Name: Jay Ambe Supermarkets

Status: Listed

IPO GMP: ₹5

Price: ₹78

Listed Price: ₹79

Profit/Loss: 1.28%

IPO Size: ₹17.52 Cr

Lot Size: 1600 Shares

Open Date: 10-September-2025

Close Date: 12-September-2025

BoA Date: 15-September-2025

Listing Date: 17-September-2025

Type: BSE SME

Company Name: JD Cables

Status: Listed

IPO GMP: ₹21

Price: ₹152

Listed Price: ₹160

Profit/Loss: 5.26%

IPO Size: ₹91.19 Cr

Lot Size: 800 Shares

Open Date: 18-September-2025

Close Date: 22-September-2025

BoA Date: 23-September-2025

Listing Date: 25-September-2025

Type: BSE SME

Company Name: Jinkushal Industries

Status: Listed

IPO GMP: ₹20

Price: ₹121

Listed Price: ₹125

Profit/Loss: 3.31%

IPO Size: ₹116.15 Cr

Lot Size: 120 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: Mainboard

Company Name: Justo Realfintech

Status: Listed

IPO GMP: ₹4

Price: ₹127

Listed Price: ₹126.9

Profit/Loss: -0.08%

IPO Size: ₹59.82 Cr

Lot Size: 1000 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: BSE SME

Company Name: Karbonsteel Engineering

Status: Listed

IPO GMP: ₹23

Price: ₹159

Listed Price: ₹185.1

Profit/Loss: 16.42%

IPO Size: ₹56.31 Cr

Lot Size: 800 Shares

Open Date: 09-September-2025

Close Date: 11-September-2025

BoA Date: 12-September-2025

Listing Date: 16-September-2025

Type: BSE SME

Company Name: Krupalu Metals

Status: Listed

IPO GMP: N/A

Price: ₹72

Listed Price: ₹57.6

Profit/Loss: -20%

IPO Size: ₹12.80 Cr

Lot Size: 1600 Shares

Open Date: 08-September-2025

Close Date: 11-September-2025

BoA Date: 12-September-2025

Listing Date: 16-September-2025

Type: BSE SME

Company Name: KVS Castings

Status: Listed

IPO GMP: ₹3

Price: ₹56

Listed Price: ₹66.3

Profit/Loss: 18.39%

IPO Size: ₹26.41 Cr

Lot Size: 2000 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: BSE SME

Company Name: L.T.Elevator

Status: Listed

IPO GMP: ₹45

Price: ₹78

Listed Price: ₹136.1

Profit/Loss: 74.49%

IPO Size: ₹37.40 Cr

Lot Size: 1600 Shares

Open Date: 12-September-2025

Close Date: 16-September-2025

BoA Date: 17-September-2025

Listing Date: 19-September-2025

Type: BSE SME

Company Name: LGT Business Connextions

Status: Listed

IPO GMP: N/A

Price: ₹107

Listed Price: ₹107

Profit/Loss: 0%

IPO Size: ₹26.68 Cr

Lot Size: 1200 Shares

Open Date: 19-August-2025

Close Date: 21-August-2025

BoA Date: 22-August-2025

Listing Date: 26-August-2025

Type: BSE SME

Company Name: M P K Steels

Status: Listed

IPO GMP: N/A

Price: ₹79

Listed Price: ₹79

Profit/Loss: 0%

IPO Size: ₹24.45 Cr

Lot Size: 1600 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: BSE SME

Company Name: Mahendra Realtors

Status: Listed

IPO GMP: ₹-10

Price: ₹85

Listed Price: ₹68

Profit/Loss: -20%

IPO Size: ₹46.97 Cr

Lot Size: 1600 Shares

Open Date: 12-August-2025

Close Date: 14-August-2025

BoA Date: 18-August-2025

Listing Date: 20-August-2025

Type: NSE SME

Company Name: Manas Polymers

Status: Listed

IPO GMP: ₹3

Price: ₹81

Listed Price: ₹153.9

Profit/Loss: 90%

IPO Size: ₹22.33 Cr

Lot Size: 1600 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: NSE SME

Company Name: Mangal Electrical

Status: Listed

IPO GMP: ₹-3

Price: ₹561

Listed Price: ₹556

Profit/Loss: -0.89%

IPO Size: ₹400.00 Cr

Lot Size: 26 Shares

Open Date: 20-August-2025

Close Date: 22-August-2025

BoA Date: 25-August-2025

Listing Date: 28-August-2025

Type: Mainboard

Company Name: Matrix Geo Solutions

Status: Listed

IPO GMP: ₹9

Price: ₹104

Listed Price: ₹103.9

Profit/Loss: -0.1%

IPO Size: ₹37.98 Cr

Lot Size: 1200 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: NSE SME

Company Name: Medistep Healthcare

Status: Listed

IPO GMP: ₹8

Price: ₹43

Listed Price: ₹53

Profit/Loss: 23.26%

IPO Size: ₹15.29 Cr

Lot Size: 3000 Shares

Open Date: 08-August-2025

Close Date: 12-August-2025

BoA Date: 13-August-2025

Listing Date: 18-August-2025

Type: NSE SME

Company Name: Munish Forge

Status: Listed

IPO GMP: N/A

Price: ₹96

Listed Price: ₹105

Profit/Loss: 9.38%

IPO Size: ₹70.23 Cr

Lot Size: 1200 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: NSE SME

Company Name: Nilachal Carbo Metalicks

Status: Listed

IPO GMP: N/A

Price: ₹85

Listed Price: ₹68

Profit/Loss: -20%

IPO Size: ₹53.28 Cr

Lot Size: 1600 Shares

Open Date: 08-September-2025

Close Date: 11-September-2025

BoA Date: 12-September-2025

Listing Date: 16-September-2025

Type: BSE SME

Company Name: NIS Management

Status: Listed

IPO GMP: N/A

Price: ₹111

Listed Price: ₹108

Profit/Loss: -2.7%

IPO Size: ₹56.34 Cr

Lot Size: 1200 Shares

Open Date: 25-August-2025

Close Date: 28-August-2025

BoA Date: 29-August-2025

Listing Date: 02-September-2025

Type: BSE SME

Company Name: Om Metallogic

Status: Listed

IPO GMP: N/A

Price: ₹86

Listed Price: ₹86

Profit/Loss: 0%

IPO Size: ₹21.22 Cr

Lot Size: 1600 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: BSE SME

Company Name: Optivalue Tek Consulting

Status: Listed

IPO GMP: ₹13

Price: ₹84

Listed Price: ₹103.6

Profit/Loss: 23.33%

IPO Size: ₹49.19 Cr

Lot Size: 1600 Shares

Open Date: 02-September-2025

Close Date: 04-September-2025

BoA Date: 08-September-2025

Listing Date: 10-September-2025

Type: NSE SME

Company Name: Oval Projects Engineering

Status: Listed

IPO GMP: N/A

Price: ₹85

Listed Price: ₹85.25

Profit/Loss: 0.29%

IPO Size: ₹44.16 Cr

Lot Size: 1600 Shares

Open Date: 28-August-2025

Close Date: 01-September-2025

BoA Date: 02-September-2025

Listing Date: 04-September-2025

Type: BSE SME

Company Name: Pace Digitek

Status: Listed

IPO GMP: ₹12

Price: ₹219

Listed Price: ₹225

Profit/Loss: 2.74%

IPO Size: ₹819.15 Cr

Lot Size: 68 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: Mainboard

Company Name: Patel Retail

Status: Listed

IPO GMP: ₹52

Price: ₹255

Listed Price: ₹300

Profit/Loss: 17.65%

IPO Size: ₹242.66 Cr

Lot Size: 58 Shares

Open Date: 19-August-2025

Close Date: 21-August-2025

BoA Date: 22-August-2025

Listing Date: 26-August-2025

Type: Mainboard

Company Name: Praruh Technologies

Status: Listed

IPO GMP: N/A

Price: ₹63

Listed Price: ₹63

Profit/Loss: 0%

IPO Size: ₹22.31 Cr

Lot Size: 2000 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: BSE SME

Company Name: Prime Cable Industries

Status: Listed

IPO GMP: ₹-2

Price: ₹83

Listed Price: ₹81

Profit/Loss: -2.41%

IPO Size: ₹38.03 Cr

Lot Size: 1600 Shares

Open Date: 22-September-2025

Close Date: 24-September-2025

BoA Date: 25-September-2025

Listing Date: 29-September-2025

Type: NSE SME

Company Name: Rachit Prints

Status: Listed

IPO GMP: N/A

Price: ₹149

Listed Price: ₹119.2

Profit/Loss: -20%

IPO Size: ₹18.52 Cr

Lot Size: 1000 Shares

Open Date: 01-September-2025

Close Date: 03-September-2025

BoA Date: 04-September-2025

Listing Date: 08-September-2025

Type: BSE SME

Company Name: Regaal Resources

Status: Listed

IPO GMP: ₹31

Price: ₹102

Listed Price: ₹141

Profit/Loss: 38.24%

IPO Size: ₹306.00 Cr

Lot Size: 144 Shares

Open Date: 12-August-2025

Close Date: 14-August-2025

BoA Date: 18-August-2025

Listing Date: 20-August-2025

Type: Mainboard

Company Name: Rukmani Devi Garg Agro Impex

Status: Listed

IPO GMP: ₹36

Price: ₹99

Listed Price: ₹79.2

Profit/Loss: -20%

IPO Size: ₹22.33 Cr

Lot Size: 1200 Shares

Open Date: 26-September-2025

Close Date: 30-September-2025

BoA Date: 01-October-2025

Listing Date: 06-October-2025

Type: BSE SME

Company Name: Saatvik Green Energy

Status: Listed

IPO GMP: ₹10

Price: ₹465

Listed Price: ₹465

Profit/Loss: 0%

IPO Size: ₹900.2 Cr

Lot Size: 32 Shares

Open Date: 19-September-2025

Close Date: 23-September-2025

BoA Date: 24-September-2025

Listing Date: 26-September-2025

Type: Mainboard

Company Name: Sampat Aluminium

Status: Listed

IPO GMP: ₹10.5

Price: ₹120

Listed Price: ₹120

Profit/Loss: 0%

IPO Size: ₹28.51 Cr

Lot Size: 1200 Shares

Open Date: 17-September-2025

Close Date: 19-September-2025

BoA Date: 22-September-2025

Listing Date: 24-September-2025

Type: BSE SME

Company Name: Sattva Engineering Construction

Status: Listed

IPO GMP: ₹24

Price: ₹75

Listed Price: ₹95.1

Profit/Loss: 26.8%

IPO Size: ₹33.58 Cr

Lot Size: 1600 Shares

Open Date: 26-August-2025

Close Date: 29-August-2025

BoA Date: 01-September-2025

Listing Date: 03-September-2025

Type: NSE SME

Company Name: Seshaasai Technologies

Status: Listed

IPO GMP: ₹40

Price: ₹423

Listed Price: ₹432

Profit/Loss: 2.13%

IPO Size: ₹813.28 Cr

Lot Size: 35 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: Mainboard

Company Name: Sharvaya Metals

Status: Listed

IPO GMP: ₹20

Price: ₹196

Listed Price: ₹219

Profit/Loss: 11.73%

IPO Size: ₹55.86 Cr

Lot Size: 600 Shares

Open Date: 04-September-2025

Close Date: 09-September-2025

BoA Date: 10-September-2025

Listing Date: 12-September-2025

Type: BSE SME

Company Name: Sheel Biotech

Status: Listed

IPO GMP: ₹16

Price: ₹63

Listed Price: ₹91

Profit/Loss: 44.44%

IPO Size: ₹32.31 Cr

Lot Size: 2000 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: NSE SME

Company Name: Shivashrit Foods

Status: Listed

IPO GMP: ₹1

Price: ₹142

Listed Price: ₹148.5

Profit/Loss: 4.58%

IPO Size: ₹66.51 Cr

Lot Size: 1000 Shares

Open Date: 22-August-2025

Close Date: 26-August-2025

BoA Date: 28-August-2025

Listing Date: 01-September-2025

Type: NSE SME

Company Name: Shreeji Shipping Global

Status: Listed

IPO GMP: ₹34

Price: ₹252

Listed Price: ₹270

Profit/Loss: 7.14%

IPO Size: ₹410.71 Cr

Lot Size: 58 Shares

Open Date: 19-August-2025

Close Date: 21-August-2025

BoA Date: 22-August-2025

Listing Date: 26-August-2025

Type: Mainboard

Company Name: Shringar House of Mangalsutra

Status: Listed

IPO GMP: ₹21

Price: ₹165

Listed Price: ₹188.5

Profit/Loss: 14.24%

IPO Size: ₹400.95 Cr

Lot Size: 90 Shares

Open Date: 10-September-2025

Close Date: 12-September-2025

BoA Date: 15-September-2025

Listing Date: 17-September-2025

Type: Mainboard

Company Name: Siddhi Cotspin

Status: Listed

IPO GMP: N/A

Price: ₹108

Listed Price: ₹86.4

Profit/Loss: -20%

IPO Size: ₹66.36 Cr

Lot Size: 1200 Shares

Open Date: 19-September-2025

Close Date: 23-September-2025

BoA Date: 24-September-2025

Listing Date: 26-September-2025

Type: NSE SME

Company Name: Snehaa Organics

Status: Listed

IPO GMP: ₹2

Price: ₹122

Listed Price: ₹122

Profit/Loss: 0%

IPO Size: ₹31.05 Cr

Lot Size: 1000 Shares

Open Date: 29-August-2025

Close Date: 02-September-2025

BoA Date: 03-September-2025

Listing Date: 05-September-2025

Type: NSE SME

Company Name: Sodhani Capital

Status: Listed

IPO GMP: N/A

Price: ₹51

Listed Price: ₹80

Profit/Loss: 56.86%

IPO Size: ₹10.17 Cr

Lot Size: 2000 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: BSE SME

Company Name: Solarworld Energy Solutions

Status: Listed

IPO GMP: ₹40

Price: ₹351

Listed Price: ₹388.5

Profit/Loss: 10.68%

IPO Size: ₹490.00 Cr

Lot Size: 42 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: Mainboard

Company Name: Solvex Edibles

Status: Listed

IPO GMP: N/A

Price: ₹72

Listed Price: ₹68

Profit/Loss: -5.56%

IPO Size: ₹17.93 Cr

Lot Size: 1600 Shares

Open Date: 22-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: BSE SME

Company Name: Star Imaging

Status: Listed

IPO GMP: ₹5

Price: ₹142

Listed Price: ₹142

Profit/Loss: 0%

IPO Size: ₹62.65 Cr

Lot Size: 1000 Shares

Open Date: 08-August-2025

Close Date: 12-August-2025

BoA Date: 13-August-2025

Listing Date: 18-August-2025

Type: BSE SME

Company Name: Studio LSD

Status: Listed

IPO GMP: N/A

Price: ₹54

Listed Price: ₹43.2

Profit/Loss: -20%

IPO Size: ₹70.53 Cr

Lot Size: 2000 Shares

Open Date: 18-August-2025

Close Date: 20-August-2025

BoA Date: 21-August-2025

Listing Date: 25-August-2025

Type: NSE SME

Company Name: Suba Hotels

Status: Listed

IPO GMP: ₹10

Price: ₹111

Listed Price: ₹154.2

Profit/Loss: 38.92%

IPO Size: ₹71.69 Cr

Lot Size: 1200 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: NSE SME

Company Name: Sugs Lloyd

Status: Listed

IPO GMP: ₹1.5

Price: ₹123

Listed Price: ₹119.9

Profit/Loss: -2.52%

IPO Size: ₹81.35 Cr

Lot Size: 1000 Shares

Open Date: 29-August-2025

Close Date: 02-September-2025

BoA Date: 03-September-2025

Listing Date: 05-September-2025

Type: BSE SME

Company Name: Sunsky Logistics

Status: Listed

IPO GMP: N/A

Price: ₹46

Listed Price: ₹51

Profit/Loss: 10.87%

IPO Size: ₹15.98 Cr

Lot Size: 3000 Shares

Open Date: 30-September-2025

Close Date: 03-October-2025

BoA Date: 06-October-2025

Listing Date: 08-October-2025

Type: BSE SME

Company Name: Systematic Industries

Status: Listed

IPO GMP: ₹1

Price: ₹195

Listed Price: ₹193.8

Profit/Loss: -0.62%

IPO Size: ₹109.75 Cr

Lot Size: 600 Shares

Open Date: 24-September-2025

Close Date: 26-September-2025

BoA Date: 29-September-2025

Listing Date: 01-October-2025

Type: BSE SME

Company Name: Taurian MPS

Status: Listed

IPO GMP: ₹14

Price: ₹171

Listed Price: ₹210

Profit/Loss: 22.81%

IPO Size: ₹37.41 Cr

Lot Size: 800 Shares

Open Date: 09-September-2025

Close Date: 11-September-2025

BoA Date: 12-September-2025

Listing Date: 16-September-2025

Type: NSE SME

Company Name: TechD Cybersecurity Limited

Status: Listed

IPO GMP: ₹210

Price: ₹193

Listed Price: ₹366.7

Profit/Loss: 90%

IPO Size: ₹37.03 Cr

Lot Size: 600 Shares

Open Date: 15-September-2025

Close Date: 17-September-2025

BoA Date: 18-September-2025

Listing Date: 22-September-2025

Type: NSE SME

Company Name: Telge Projects

Status: Listed

IPO GMP: N/A

Price: ₹105

Listed Price: ₹108.1

Profit/Loss: 2.95%

IPO Size: ₹25.87 Cr

Lot Size: 1200 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: BSE SME

Company Name: TruAlt Bioenergy

Status: Listed

IPO GMP: ₹85

Price: ₹496

Listed Price: ₹547.1

Profit/Loss: 10.3%

IPO Size: ₹839.28 Cr

Lot Size: 30 Shares

Open Date: 25-September-2025

Close Date: 29-September-2025

BoA Date: 30-September-2025

Listing Date: 03-October-2025

Type: Mainboard

Company Name: True Colors

Status: Listed

IPO GMP: ₹5

Price: ₹191

Listed Price: ₹191

Profit/Loss: 0%

IPO Size: ₹121.54 Cr

Lot Size: 600 Shares

Open Date: 23-September-2025

Close Date: 25-September-2025

BoA Date: 26-September-2025

Listing Date: 30-September-2025

Type: BSE SME

Company Name: Urban Company

Status: Listed

IPO GMP: ₹54

Price: ₹103

Listed Price: ₹162.25

Profit/Loss: 57.52%

IPO Size: ₹1900.00 Cr

Lot Size: 145 Shares

Open Date: 10-September-2025

Close Date: 12-September-2025

BoA Date: 15-September-2025

Listing Date: 17-September-2025

Type: Mainboard

Company Name: Vashishtha Luxury Fashion

Status: Listed

IPO GMP: ₹8

Price: ₹111

Listed Price: ₹118

Profit/Loss: 6.31%

IPO Size: ₹8.42 Cr

Lot Size: 1200 Shares

Open Date: 05-September-2025

Close Date: 10-September-2025

BoA Date: 11-September-2025

Listing Date: 15-September-2025

Type: BSE SME

Company Name: Vigor Plast

Status: Listed

IPO GMP: N/A

Price: ₹81

Listed Price: ₹85

Profit/Loss: 4.94%

IPO Size: ₹23.85 Cr

Lot Size: 1600 Shares

Open Date: 04-September-2025

Close Date: 09-September-2025

BoA Date: 10-September-2025

Listing Date: 12-September-2025

Type: NSE SME

Company Name: Vijaypd Ceutical

Status: Listed

IPO GMP: N/A

Price: ₹35

Listed Price: ₹35.1

Profit/Loss: 0.29%

IPO Size: ₹18.26 Cr

Lot Size: 4000 Shares

Open Date: 29-September-2025

Close Date: 01-October-2025

BoA Date: 03-October-2025

Listing Date: 07-October-2025

Type: NSE SME

Company Name: Vikram Solar

Status: Listed

IPO GMP: ₹35

Price: ₹332

Listed Price: ₹338

Profit/Loss: 1.81%

IPO Size: ₹2079.37 Cr

Lot Size: 45 Shares

Open Date: 19-August-2025

Close Date: 21-August-2025

BoA Date: 22-August-2025

Listing Date: 26-August-2025

Type: Mainboard

Company Name: Vikran Engineering

Status: Listed

IPO GMP: ₹7

Price: ₹97

Listed Price: ₹99

Profit/Loss: 2.06%

IPO Size: ₹772.00 Cr

Lot Size: 148 Shares

Open Date: 26-August-2025

Close Date: 29-August-2025

BoA Date: 01-September-2025

Listing Date: 03-September-2025

Type: Mainboard

Company Name: VMS TMT

Status: Listed

IPO GMP: ₹11

Price: ₹99

Listed Price: ₹104.9

Profit/Loss: 5.96%

IPO Size: ₹148.50 Cr

Lot Size: 150 Shares

Open Date: 17-September-2025

Close Date: 19-September-2025

BoA Date: 22-September-2025

Listing Date: 24-September-2025

Type: Mainboard

Gray Market IPO Mystery: What Every IPO Investor Should Really Know About GMP

Let's be honest—IPOs can feel like a roller coaster. Especially when everyones talking about this mysterious thing called “Grey Market Premium” or GMP. You've probably heard friends say “Oh the GMP is really high on this one!” and wondered what the heck they're talking about. Trust me I've been there too.

What Exactly Is This Grey Market Thing?

Think of the grey market as the unofficial hangout spot for stock traders before an IPO goes live. It's not illegal but its also not officially recognized by SEBI or the stock exchanges. Picture it like this: you and your friends agreeing to trade baseball cards before the official card shop opens. Everything runs on trust handshake deals and a lot of hope.

The grey market kicks into gear the moment a company announces it's IPO price band—usually 10-15 days before the actual subscription opens. Its where people buy and sell IPO shares (or even just applications) based on what they think the stock will be worth once it hits the real market.

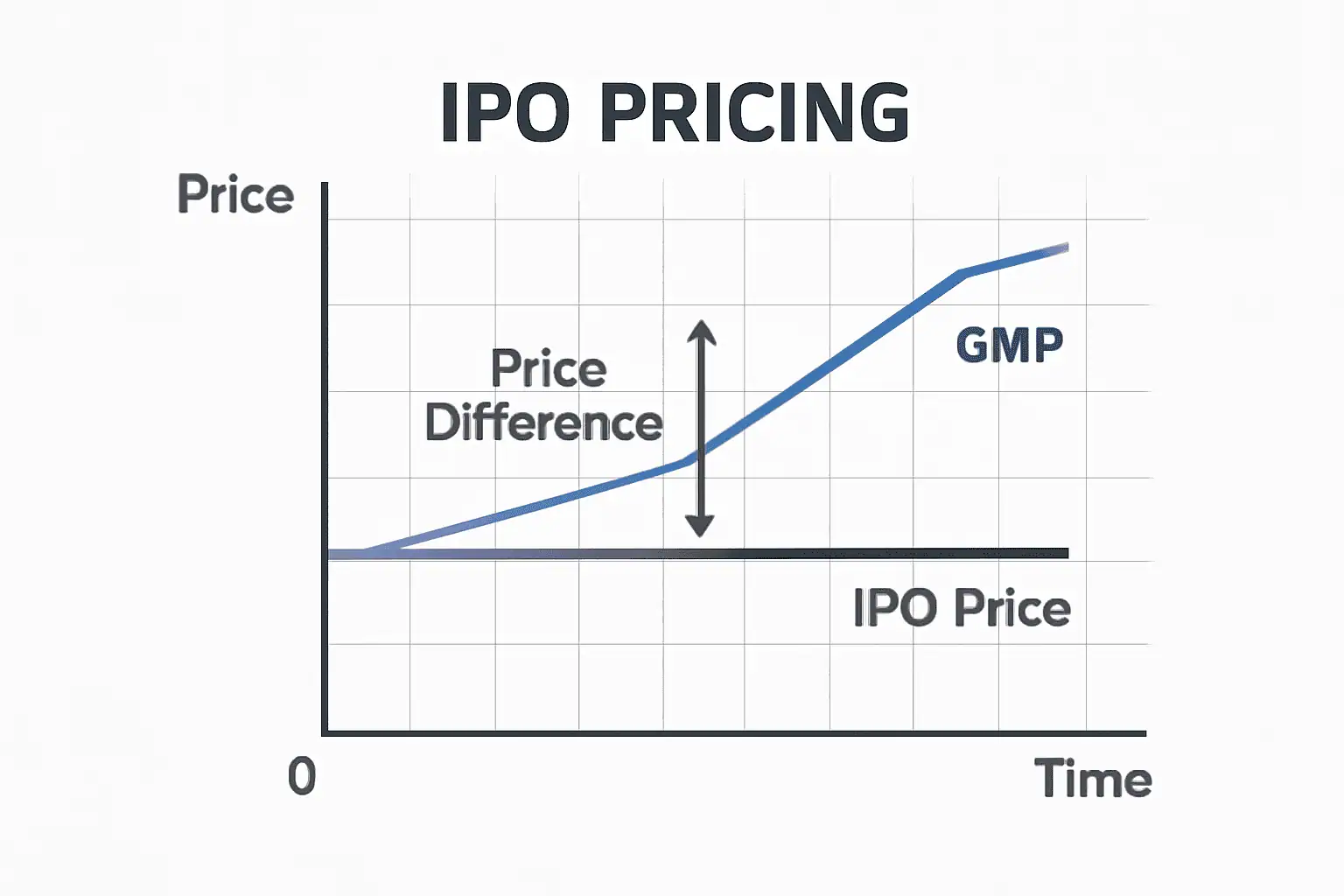

Breaking Down Grey Market Premium (GMP)

Heres where it gets interesting. GMP is simply the extra amount people are willing to pay above the IPO issue price in this unofficial market.

Lets say XYZ Company prices their IPO at ₹100 per share. But in the grey market people are trading it for ₹150. That ₹50 difference? Thats your GMP. Its basically the markets way of saying “We think this stock is going to list higher than the issue price.”

The math is pretty straightforward:

Expected Listing Price = IPO Issue Price + GMP

The Players and The Game

The grey market isn't run by some shadowy organization (though it sounds like it right?). Its mostly operated by dealers and brokers who know each other and have built trust over years of trading. They match buyers with sellers take their cut and everyone hopes for the best.

What makes this interesting is that these arent just random people—often you'll find institutional investors HNIs (High Net Worth Individuals) and even retail investors who know the ropes.

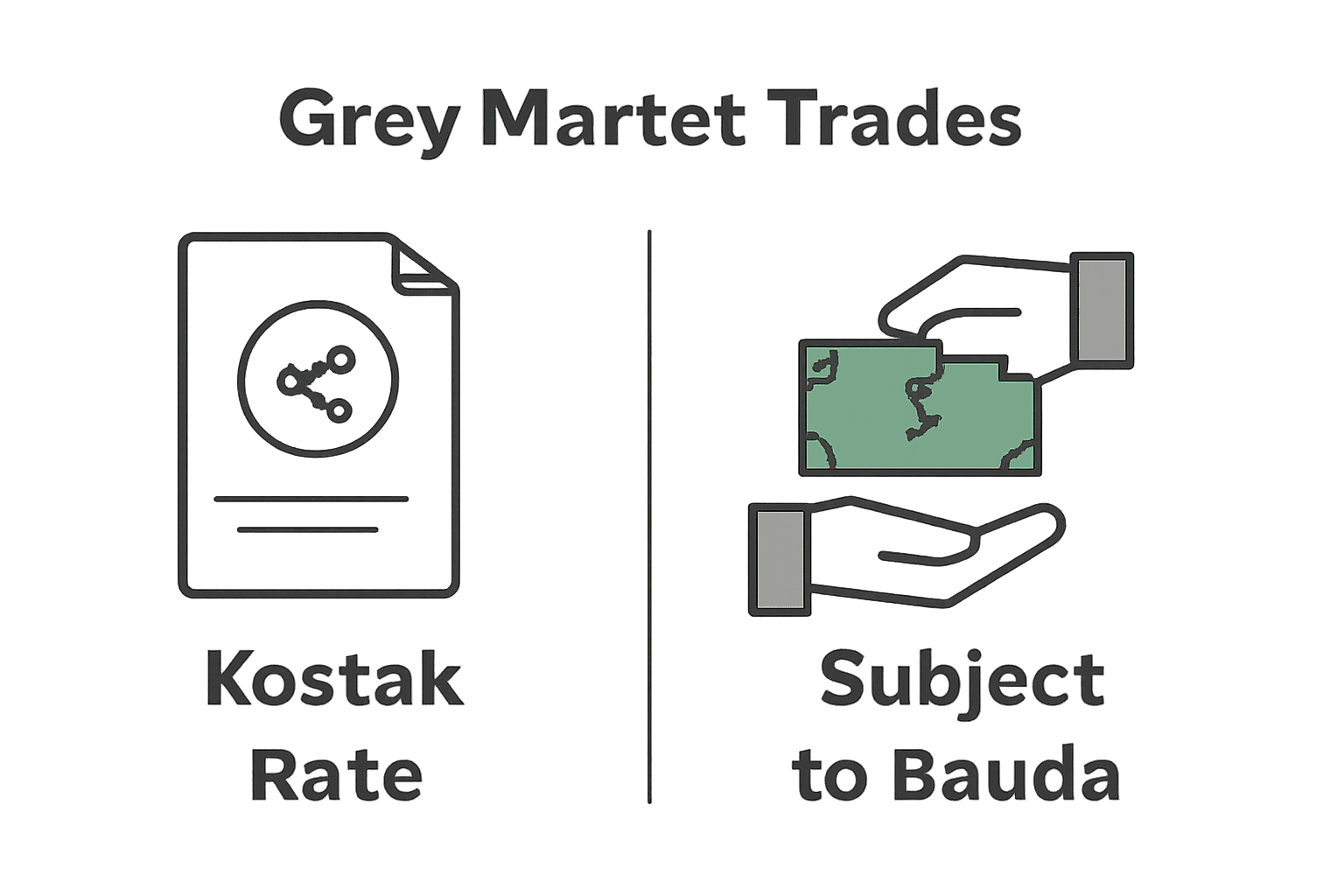

Beyond GMP: Kostak Rate and Subject to Sauda

Now heres where things get a bit more complex (but stick with me—its actually pretty clever). There are two other ways people trade in the grey market:

Kostak Rate: This is when someone buys your entire IPO application—whether you get shares or not. Say you applied for an IPO someone offers you ₹1,000 for your application. Win or lose you get that ₹1,000 but you give up any potential gains.

Subject to Sauda: This is like Kostaks cautious cousin. The buyer only pays you if you actually get the share allotment. No allotment? No deal. Its safer for the buyer which is why these rates are usually higher than Kostak rates.

The Reality Check: Can You Trust GMP?

Here's the thing—and this is where I need to be completely honest with you—GMP is basically educated guesswork with a fancy name. Sure it can give you a sense of market sentiment but its not some crystal ball that predicts the future.

Ive seen IPOs with sky-high GMPs crash on listing day and others with modest GMPs surprise everyone with stellar debuts. The grey market runs on speculation and speculation can be wrong—really wrong.

The Risks Nobody Talks About Enough

Lets address the elephant in the room. Trading in the grey market is risky business:

No Legal Protection: If someone backs out of a deal you cant run to SEBI or the courts. Its all based on trust.

Price Manipulation: Since theres no official price discovery dealers can pretty much quote whatever they want.

Volatility: GMP can swing wildly based on rumors market sentiment or even what someone had for breakfast.

No Transparency: Unlike official stock exchanges where you can see order books and trading volumes the grey market is like playing poker with your cards face down.

How to Use GMP Wisely (If At All)

Look Im not going to tell you to completely ignore GMP—it does reflect investor sentiment to some degree. But if youre going to pay attention to it heres how to be smart about it:

Use It as One Indicator Among Many: Dont let GMP be your only deciding factor. Look at the companys fundamentals the market conditions and the sector outlook.

Watch the Trend Not Just the Number: Is the GMP rising or falling? Are people getting more excited or cooling off?

Remember Its Unofficial: Treat GMP numbers like you would gossip—interesting possibly useful but not necessarily true.

The Bottom Line

The grey market and GMP are fascinating parts of Indias IPO ecosystem. They give us a peek into what people think before the official show begins. But remember—this is all happening in the shadows without rules or referees.

If youre new to IPO investing my advice? Learn about GMP understand what it means but dont let it drive your investment decisions. Focus on the companys business model growth prospects and whether it fits your investment goals.

And if you do decide to dabble in grey market trading? Go in with your eyes wide open never invest more than you can afford to lose and remember that trust is the only currency that matters in this unofficial world.

The grey market will probably always be part of Indias IPO story—its too ingrained in our investing culture to disappear. Just make sure you understand the game before you decide to play.

Happy investing and remember—sometimes the best trade is the one you don't make!